Grains Retreat With Tariff Talk and End of Month Profit Taking

Grain and Livestock Markets Come Under Pressure

Profit taking in grains and cattle was seen as we approach the last trading day of the month. Oliver Sloup was on RFD-TV yesterday sharing his thoughts on the markets.

Corn

Technicals

March corn futures failed to take out Wednesday’s high in yesterday’s trade which may have led to some profit taking. That weakness has spilled into the overnight trade with help from Mexico/Canada tariff talk that is set to go into place this weekend. Support remains intact from 477 3/4-479 3/4. A failure here could trigger additional weakness via profit taking. December futures have been the strong month in the last 24 hours, something to consider whether you’re trading outright or as a spread.

Technical Levels of Importance

- Resistance: 494 1/2**, 499-502 1/4**, 508 1/3-510****

- Pivot: 487-488

- Support:477 3/4-479 3/4***, 469 1/4-471 1/2***

Fundamental Notes

- Weekly Export Sales: Net sales of 1,358,500 MT for 2024/2025 were down 18 percent from the previous week, but up 39 percent from the prior 4-week average. Increases primarily for Japan (493,100 MT, including 181,500 MT switched from unknown destinations and decreases of 1,300 MT), Mexico (426,900 MT, including 55,000 MT switched from unknown destinations and decreases of 2,700 MT), Spain (140,700 MT, including 63,000 MT switched from unknown destinations and 71,500 MT – late), South Korea (136,800 MT, including 130,000 MT switched from unknown destinations), and Colombia (129,200 MT, including 90,000 MT switched from unknown destinations and decreases of 1,800 MT), were offset by reductions for unknown destinations (482,500 MT) and Morocco (1,700 MT). Total net sales of 45,800 MT for 2025/2026 were for Japan. Exports of 1,320,200 MT were down 13 percent from the previous week, but up 9 percent from the prior 4-week average. The destinations were primarily to Japan (335,700 MT), Mexico (314,700 MT), South Korea (141,800 MT), Spain (140,700 MT), and Colombia (122,200 MT).

- Brazil Corn Planting: With global corn supplies set for decade lows later this year, Brazil’s corn harvest cannot afford a mishap.Brazilian corn stocks are particularly tight heading into 2024-25, and planting of the second corn crop, which accounts for almost 80% of the country’s corn production, is off to a slow start.Brazil’s second corn output is predicted to rise modestly this year versus last, though if that fails, it could spell opportunity for the United States.Second corn in top growing state Mato Grosso was just 1% planted as of last Friday, the date’s slowest pace since 2011 but nearly identical to 2021. Both of those years plus 2016, another slow year, coincided with some of the state’s poorest corn yields. -Reuters

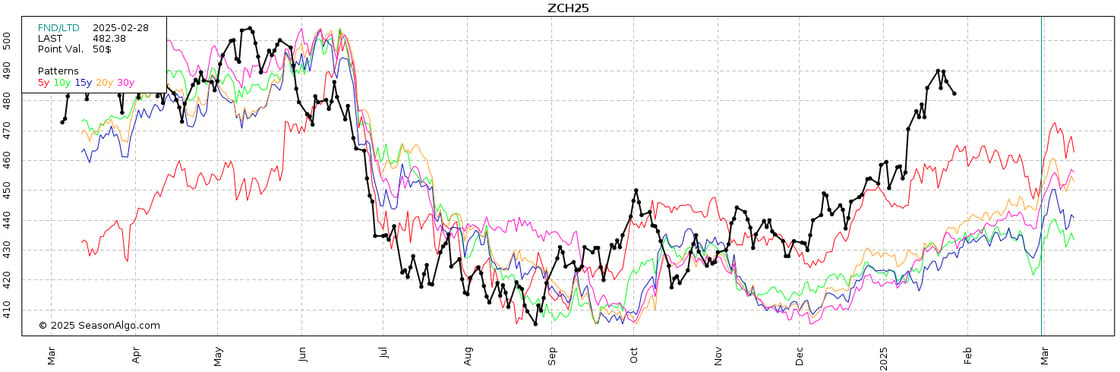

Seasonal Tendencies Update

(Updated on 1.27.25)

Below is a look at historical price averages for March corn futures on a 5, 10, 15, 20, and 30 year time frames (Past performance is not necessarily indicative of future results).

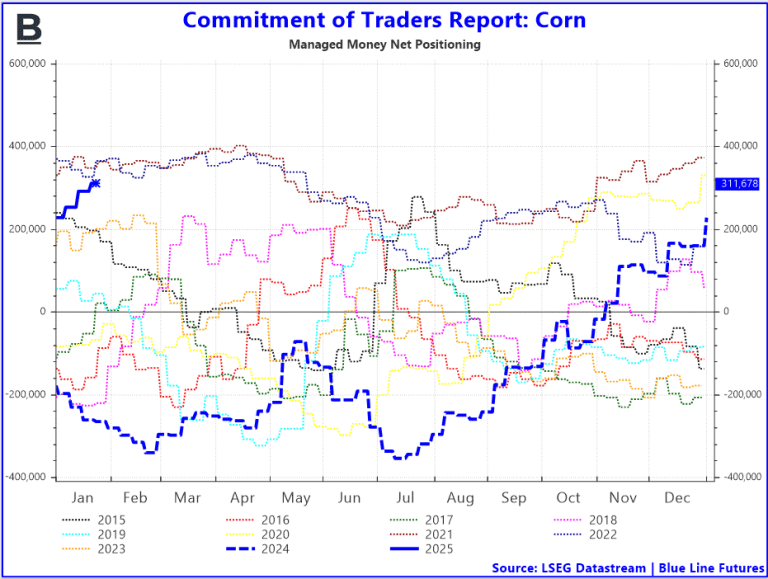

Commitment of Traders Update

- Managed money has amassed a considerable net-long position, which now totals 311,678 contracts between futures and options.

Ready to dig in?

Subscribe to our daily Grain Express for fresh insights into Soybeans, Wheat, and Corn. Get our expert technical analysis, proprietary trading levels, and actionable market bias delivered right to your inbox.

Sign Up for Free Futures Market Research – Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Performance Disclaimer

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.