What to Expect From Bristol-Myers Squibb's Next Quarterly Earnings Report

/Bristol-Myers%20Squibb%20Co_%20logo%20on%20building-by%20tatu%20Campelo%20via%20iStock.jpg)

Princeton, New Jersey-based Bristol-Myers Squibb Company (BMY) is one of the leading biopharmaceutical companies focused on developing treatments for diseases like cancer, inflammatory, immunologic, cardiovascular, and fibrotic diseases. With a market cap of $89.5 billion, Bristol-Myers’ operations span various countries in the Americas, Europe, and the Indo-Pacific.

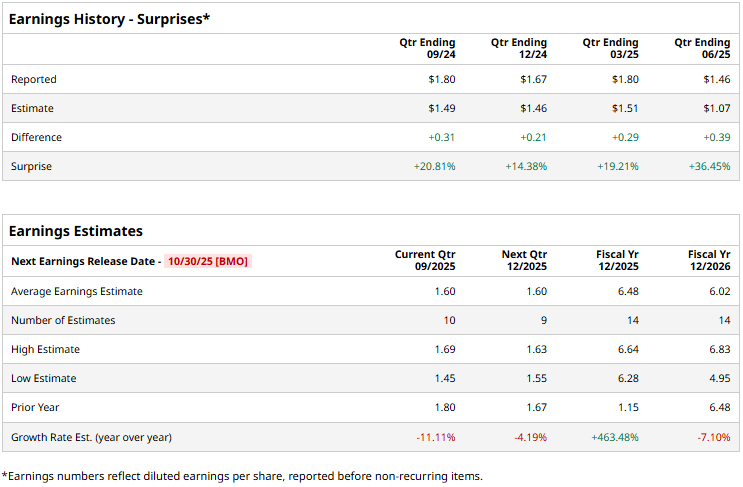

The biopharma giant is set to unveil its third-quarter results before the market opens on Thursday, Oct. 30. Ahead of the event, analysts expect BMY to deliver a profit of $1.60 per share, down 11.1% from $1.80 per share reported in the year-ago quarter. On a positive note, the company has a solid earnings surprise history and has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect BMY to deliver an EPS of $6.48, significantly up from $1.15 reported in the previous year. While in fiscal 2026, its earnings are expected to drop 7.1% year-over-year to $6.02 per share.

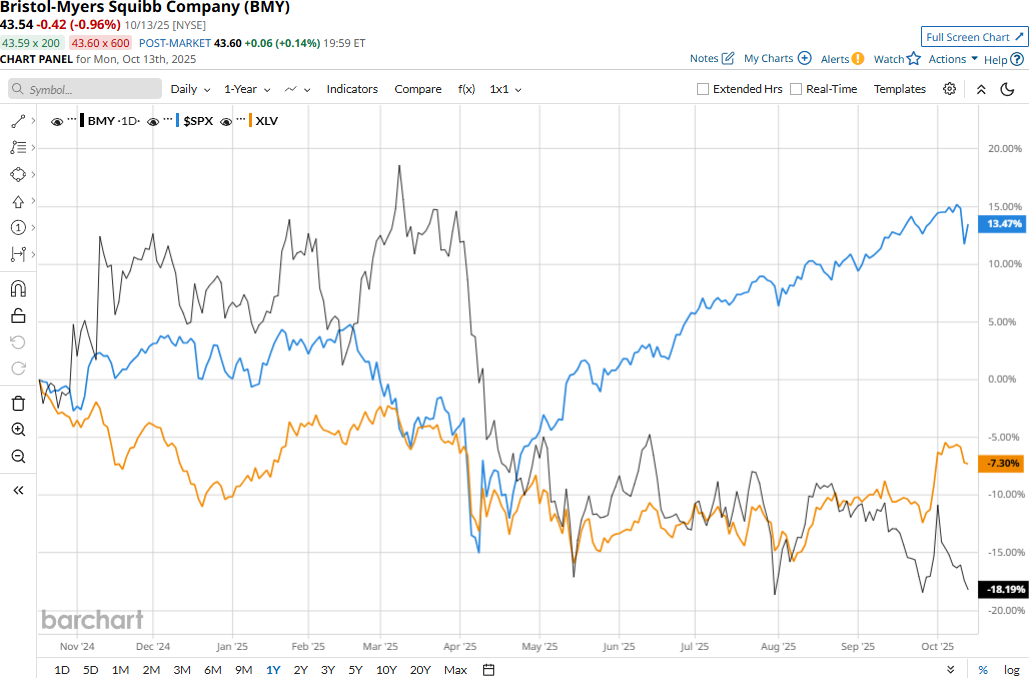

BMY stock prices have plummeted 16.6% over the past 52 weeks, notably underperforming the Health Care Select Sector SPDR Fund’s (XLV) 7.8% decline and the S&P 500 Index’s ($SPX) 14.4% gains during the same time frame.

Despite reporting better-than-expected results, Bristol-Myers Squibb’s stock prices plunged 5.8% in a single trading session following the release of its Q2 results on Jul. 31. The company's legacy portfolio’s revenues have remained under constant pressure due to generic erosion, leading to a 14% decrease in sales to $5.7 billion. However, its growth portfolio’s sales soared 18% year-over-year to $6.6 billion. Overall, the company’s revenues came in at $12.3 billion, up 56 bps and 7.7% ahead of expectations. Meanwhile, BMY’s adjusted EPS declined 29.5% year-over-year to $1.46, but surpassed the consensus estimates by a staggering 36.5%.

The sell-off resulted from BMY lowering its full-year adjusted EPS guidance from the previous range of $6.70-$7 to $6.35-$6.65, falling significantly below the consensus estimates.

The stock maintains a consensus “Hold” rating overall. Of the 29 analysts covering the BMY stock, opinions include six “Strong Buys,” one “Moderate Buy,” 21 “Holds,” and one “Strong Sell.” Its mean price target of $52.64 suggests a 20.9% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.